Stage Guide

Learn about each stage of the U.S. business cycle and the key indicators that define them. Our AI-powered guide helps you understand economic trends and their implications.

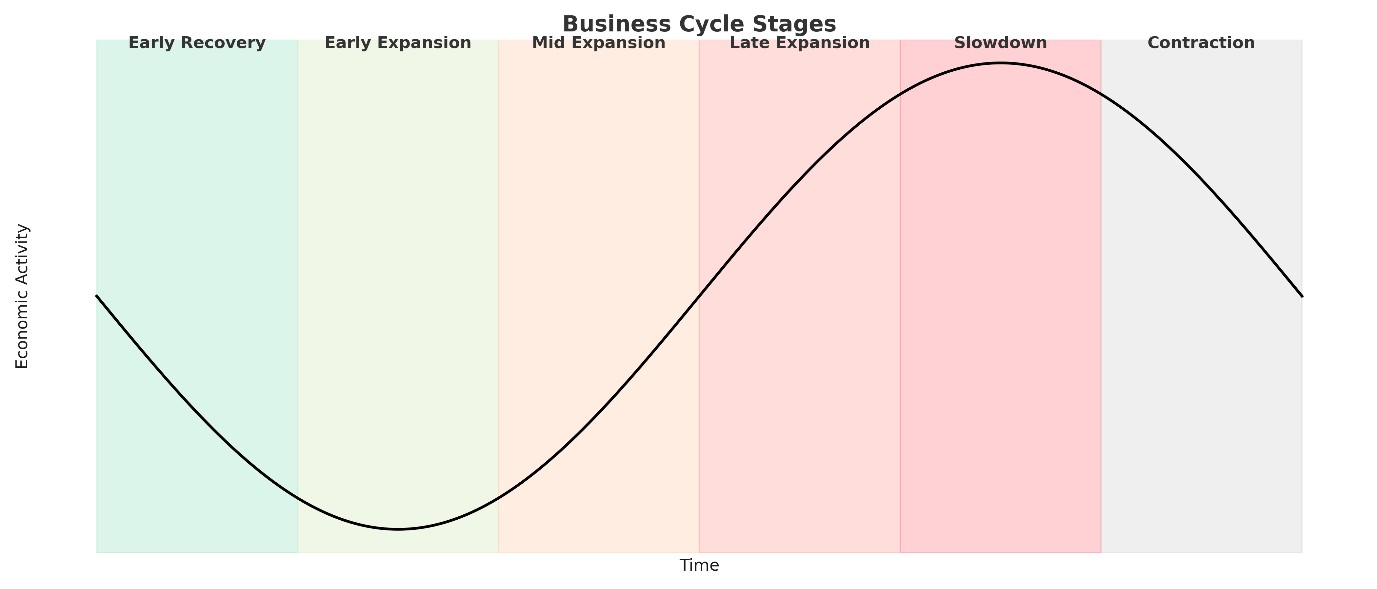

The 6 Stages of the Economic Cycle

Economic activity moves in recurring patterns. Analysts often describe these movements in six broad stages, each with unique features.

Stage 1 – Early Recovery

- The economy starts to rebound after a slowdown.

- Inflation is low or declining.

- Interest rates are often supportive.

- Output and demand begin to grow, though cautiously.

Stage 2 – Early Expansion

- Growth picks up steadily.

- Employment begins to rise, and consumer spending improves.

- Business investment starts to recover.

- Inflation remains contained at low to moderate levels.

Stage 3 – Expansion

- Growth is solid and broad-based across sectors.

- Labor markets are strong with low unemployment.

- Services and manufacturing both contribute to activity.

- Inflation is moderate and manageable.

Stage 4 – Late Expansion

- Economic activity is at or near peak capacity.

- Inflation pressures increase.

- Central banks may raise interest rates.

- Asset prices are strong but volatility can rise.

Stage 5 – Slowdown

- Growth begins to lose momentum.

- Business and consumer confidence weaken.

- Employment growth slows.

- Inflation may remain high for a time, even as output cools.

Stage 6 – Contraction

- Output declines across key sectors.

- Unemployment rises.

- Demand weakens significantly.

- Inflation falls or turns into deflation.

- Policy measures are often introduced to stabilize activity.

Note: This guide is for research and educational purposes only. It describes common stages of the economic cycle and does not constitute financial advice.